Recommended News For Selecting Fx Trading Sites

Wiki Article

Top 10 Broker Selection Tips In The Event Of Thinking About Forex Trading Online

It is crucial to select the right Forex Broker as it will affect your trading security and overall experience. Here are the top ten things to think about when selecting a Forex broker: 1.

Verify the status of a company's regulatory status and reputation

1. Find brokers that are regulated by an authoritative authority with credibility, such as the U.S. CFTC. UK FCA. Australian ASIC. EU CySEC. Regulations ensure that brokers comply with the standards of their industry, guaranteeing the safety of your funds as well as the fairness of trading practices. Avoid unregulated brokers and those who have faced previous complaints.

2. Costs of trading (Spreads and Commissions).

Brokers earn commissions and spreads. Look for brokers who offer transparent, competitive fees. If you're a frequent trader such as an agent that has tight spreads may be a more efficient option. Be aware of hidden charges such as inactivity or withdrawal fees.

3. Take a look at the range of currency pairs offered

Check that the broker offers a broad selection of currency pairs that you are interested in trading, which includes major pairs (like EUR/USD) and exotic or minor pairs that are appropriate to your strategy. It is possible to diversify your trading and profit from market opportunities with a larger range of options.

4. Trading Platform and Tools Review them

The trading platform is your main interface with the market, and therefore needs to be intuitive as well as reliable and loaded with tools that complement your trading style. Numerous brokers offer MetaTrader 4 and MetaTrader 5 platforms, along with custom-built software. Try the features like charting, technical indicators, order execution speed and other platform features before committing.

5. Check out the different types of accounts and leverage options

Brokers will often offer different types of accounts that have different spreads and leverage. They may additionally have different minimum deposit requirements. Choose a Broker that offers accounts that are appropriate to your budget, experience and style of trading. If you're just beginning to learn about trading, stay away from brokers who offer very high leverage. They could result in huge losses.

6. Review your Deposit and Withdrawal Options

Check out the deposit and withdrawal options and the fees associated with them and processing time. A reliable broker will provide convenient, safe, and low-cost methods, like transfer to banks or credit card transactions or trusted electronic wallets like copyright or Skrill. Beware of brokers with excessive withdrawal charges or lengthy processing times.

7. Test Customer Support Responsiveness

The importance of having a stable support system is crucial especially when you need to solve urgent issues. Contact the broker through various channels (live chats, emails, or telephones) to assess their professionalism and knowledge. Find brokers that provide 24/7 customer support in the event that your transaction is not during normal working hours.

8. Security Measures and Fund Protection

You can be confident that your funds are secure when you work with a broker that is trustworthy. Verify if the broker stores client funds in segregated accounts (separate from the broker's operational funds) and provides security against negative balances that prevents you from losing more than the balance of your account. These safeguards will shield you in the case of insolvency for the broker and market volatility.

9. Look for Educational Resources and support for beginners.

The best brokers provide educational materials, like webinars. Trading guides, market analysis, as well as demo accounts. These tools can be extremely useful, especially if your are new to Forex trading. Demo accounts offer you the chance to try trading without the risk of losing your actual money.

10. Read Independent Reviews to Seek Recommendations

Reviews by other traders provide useful information about the advantages and disadvantages of a particular broker, including concealed charges, withdrawal problems or platform issues. There are reviews available on reliable forums for trading, review sites and communities. Beware of fake reviews and overly promotional remarks. Experienced traders will help you make the right decision.

Choosing the right Forex broker involves careful consideration of a variety of aspects. You must take into consideration transparency as well as regulatory requirements and the overall market environment to choose a broker that is able to meet your requirements. Check out the top https://th.roboforex.com/ for blog info including currency trading demo account, platform for trading forex, forex trading trading, forex demo account, fbs broker review, forex trading brokers, forex broker platform, fx online trading, forex brokers list, best forex trading broker and more.

If You Are Thinking About Trading Forex Online Here Are 10 Helpful Tips On How To Make The Most Of Your Account.

The leverage in Forex trading is an extremely effective tool, increasing both potential gains and losses. We have compiled our top 10 tips for understanding and utilize leverage effectively.

1. Knowing the fundamentals of leverage

Leverage is a way to take control of an investment that is greater than the amount of capital you have. For instance, a leverage of 1:100 means that you can control 100 dollars on the market for every dollar in your account. This also implies that any move within the market will affect your balance by this same factor. It can therefore increase both gains as well as losses.

2. Know the risks associated with high leverage

Leverage can increase profits as well as losses. With leverages of 1 to 500, even the slightest 0.2% decline in price can erase the whole investment. Beginning traders might be enticed to make use of high leverage, but it is important to remember that it can lead to massive losses when markets are not in their favor.

3. Start with a Low Leverage

Begin trading Forex using a lower leverage ratio. For example 1:10 to 1:120. This will keep your losses under control and help you build confidence and experience.

4. Calculate the Margin requirement

Every leveraged trade comes with a margin requirement--the amount you need to maintain in your account before you can open an account. A $10,000 trade, for instance, requires just $100 of margin. Be sure to understand the margin requirements so you are able to avoid liquidation or requests for additional margin.

5. Utilize leverage in line with your trading strategy

Due to the tight placement of stop-loss stops, traders who trade on a short-term basis may profit from moderate leverage. Leverage can be utilized to trade long-term, which is more volatile. Adjust leverage to suit the timeframes and goals for every trade.

6. Set Strict Loss Stop-Orders for Every Trade

A stop-loss order limits the losses on a leveraged position, protecting your capital if the market moves against you. You can set your stop-loss based on your risk tolerance. This discipline can help keep losses from escalating.

7. Monitor Your Leverage Ratio Regularly

Your leverage ratio could fluctuate when your balance fluctuates and you should be monitoring your portfolio to ensure that you aren't over-leveraged unintentionally. The leverage ratio can be maintained by reducing or putting a stop to certain trades.

8. Make use of a Margin Calculator.

Many brokers offer margin calculators or tools to help you determine how much leverage you're utilizing and the amount of margin needed for a trade. These tools can help you better understand the potential risks and help you avoid using excessive leverage.

9. Be aware of the different leverage restrictions in each region

Different regions have different leverage limits in accordance with the regulations. For instance, in the U.S. for example, retail traders have a maximum leverage ratio of 1:50 while in the EU the leverage limit on major currency pairs has been set at 1:30. It is recommended to select a ratio of leverage within legal limits in order to comply with the law and minimize your risk.

10. Re-evaluate your leverage in light of current market conditions

Market conditions can undergo rapid change and can affect the risk profile associated with leveraged trading. If you are trading during market volatility, or during high-impact announcements or news releases cut back on your leverage. If you're in an uncertain time that is not predictable, reducing leverage could safeguard your investment against abrupt price fluctuations.

In conclusion, when using leverage, it is important to understand its benefits as well as the risks. When you are using it properly and creating protective stop-loss guidelines and selecting the appropriate leverage ratio you'll be able to reap its benefits, while minimizing risk. Take a look at the top https://th.roboforex.com/about/company/news/ for more info including forex market online, currency trading demo account, forex market online, united states forex brokers, regulated forex brokers, forex broker platform, forex trading brokers list, forex best trading app, best currency trading platform, forex demo account and more.

Top 10 Trading Platform And Technology Tips When Considering Online Forex Trading

1. In order to trade Forex effectively, it's important to select the right platform and understand the technologies involved. Here are 10 suggestions to help you navigate trading platforms and leverage technology for an enhanced trading experience.

Choose a User-Friendly Platform

Opt to use a platform you can easily navigate. You should be able to navigate charts, manage trades, and place orders. Platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5) and TradingView are well-known for their user-friendly interfaces and flexibility.

2. Ensure Strong Internet Connectivity

Forex trading requires reliable Internet access. An unstable or slow internet connection could result in missed opportunities, slippage and delays in order execution. Think about upgrading your internet or making use of the Virtual Private Server for a more stable connection.

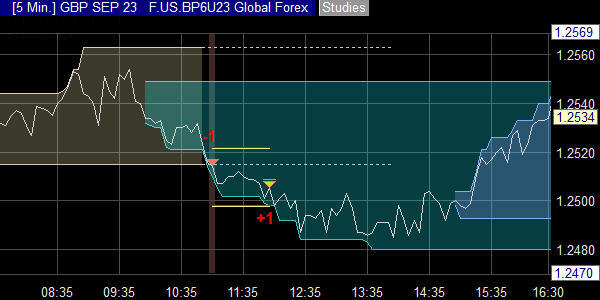

3. Speed of Test Order Execution

A speedy processing of orders is crucial particularly if scalping or day trading are your main activities. A platform that has quick execution times will reduce slippage. This ensures you are in a position to trade and withdraw trades at the prices you've set. Demo accounts are an excellent method to test the speed of the platform prior to committing.

4. Explore Charting and Analysis Tool

A reliable platform must provide advanced charting indicators, charts, as well as technical analysis tools. Platforms that offer customizable charts, access to a range of indicators, and provide thorough technical analysis are the best. It will help you make better decisions when trading.

5. Verify the capabilities of mobiles for trading

Mobile trading apps offer flexibility in monitoring and managing trades while on the go. Be sure that the app you choose to use offers an app that is reliable and has all the features you require for example, charts, trade execution and monitoring your account, all without compromising user-friendliness.

6. Automated Trading Options

Many traders rely on automated trading and algorithmic strategies to decrease their manual work load, increase consistency, and enhance efficiency. If you are interested in automation select a platform that has expert advisors or robots for trading. For example, MT4 and MT5 are compatible with various automated trading software.

7. Verify the security features

Online trading demands a high degree of security. Select a platform for trading that offers encryption protocols, two factor authentication (copyright) in addition to as other security features. This will protect your personal information and funds. Be cautious of platforms that do not have strong security features. They may expose your data and funds to cyber-attacks.

8. Check for Real-Time Data and News Feeds

Real-time price feeds and economic news alerts are vital to make timely trade decisions. A good platform offers accurate, current market data and news feeds from reputable sources. This will allow you to stay informed about events which could impact your trading.

9. Test Compatibility With Your Trading Style

Different platforms suit different trading styles. Platforms that have quick execution and one click trading are ideal for scalpers. Those with advanced charts and analytical tools are more suitable for swing traders. Make sure that the platform you select matches your trading style.

10. Test customer support and platform reliability

A reliable customer service is essential, especially when you are experiencing platform problems or need technical assistance. Test the support team's responsiveness and expertise by contacting them with questions. Also, check out the history of the platform's stability and uptime, as frequent downtimes or crashes could influence the performance of your trading.

By carefully selecting the right trading platform with your preferences and a thorough understanding of the technical aspects, you can improve your trading efficiency and remain better prepared to manage market fluctuations. It is important to prioritize usability and security and the right tools that will help you trade. View the top rated https://th.roboforex.com/about/activity/awards/ for more examples including best currency trading platform, forex trading brokers list, forex trading trading, trading foreign exchange, top forex trading apps, forex app trading, platform for trading forex, forex and trading, recommended brokers forex, forex exchange platform and more.